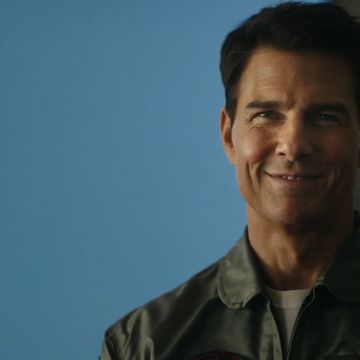

Yaya DaCosta is a big believer in visualizing your goals and says she uses the power of music to inspire her while concentrating on specific goals she wants to achieve. This formula is clearly working for her. The introspective actress has crafted quite the career for herself. From starring in the 2015 Lifetime biopic Whitney to playing April Sexton on Chicago Med, DaCosta has proven she’s a force in the acting world. And she’s set to do that again in season 2 of Netflix legal drama series The Lincoln Lawyer, out now. She plays prosecutor Andrea Freemann, a role she says is “unlike any character” she’s portrayed in the past.

Interestingly enough, DaCosta considered going to law school while attending Brown University for undergrad. But her dream of acting prevailed, and she set to work to make it a reality. Here, DaCosta talks more about her new role and her belief that you have to be intentional about what you want in life.

What did you enjoy most about playing Andrea?

I enjoyed playing her as a real character, as someone who had a consistent, specific energy. Her attitude was very particular. When she walked in the room, you felt her presence. When she spoke, everyone listened. I really loved that about her. I also loved her outfits—her suits were really fly.

More From Oprah Daily

Have you always wanted to act?

When I was in undergrad, I toyed with the idea of going to law school afterward. But I decided, once and for all, to see if I could really make this childhood dream happen—I first started acting in educational films in junior high school. I wanted to give it a shot before I decided to do anything else. It took a few years for that level of confidence to really take root, like, Actually, this is what I do, this is one of the things I am meant to do. And no, I’m not gonna go back to school. Actually, I’m not going to law school. Lots of my friends from college are lawyers, and we kind of laugh at that. Because one of the beautiful opportunities of being an actor is to live out the dreams of the younger version of ourselves, even if it’s only for a couple of months, or only for a season on TV.

Your busy career must keep you on the go—what do you do when you have a minute to unwind?

I’m a proud mother of one, a nurturer, and have been a meditator since childhood. I love dance, yoga, and travel. I am also a doula. I’ve spent a lot of time doing birth work and learning about different healing modalities, whether it’s practicing reiki or tuning in to other forms of wisdom and having conversations around mysticism and why we’re here. I love all that stuff, and making things with my hands, cooking, feeding loved ones, crocheting, and sewing. Also, making jewelry—I’m a creator, for real.

Do you use a journal or vision board?

I journal daily and meditate daily upon waking. Vision boards are something I got into not that long ago—maybe in 2017. My favorite thing about them is being able to look back at them. It’s this amazing invitation to have gratitude for the universe. I put six seasons of Chicago Med, and that’s exactly what I did. I put all these visions on it—I was so attracted to certain images and words for a reason. So when you actually put them on paper, it’s proof that we’re doing what we’re supposed to do—that we’re on the right track. And that we’re being heard, and while we’re receiving our blessings, we’re also doing our part. I also do vision playlists. For whatever theme I’m working on, I find songs that support that and play them on repeat. A lot of that music feeds that part of my brain that is working on the level up in that area. And let me tell you: It’s been working.

How do you start your morning when you have a busy day ahead?

I meditate, I write. First, I jot down information I may have gotten from my dreams. I love dreaming. I journal. I try to do some physical movement depending on how much time I have. If I don't have time for a workout, I'll do something quick to really wake me up, whether it's jump rope, or sometimes I'll cold plunge in the morning just to really wake me up and get going. I love smoothies: I like to pack in all of my nutrients and all the things I love into the hugest tumbler that I sip throughout the morning.

What’s one question every woman should ask herself?

I think women are natural nurturers and givers. We are receptive by nature and by physical design, and we are also taught to give. But oftentimes, we’re not taught to give to ourselves first. So my question for women would be: Are you giving from the overflow of your cup?

You can stream season 2, part 1 of The Lincoln Lawyer on Netflix now. Part 2 drops on the platform on August 3.

This interview has been edited and condensed for clarity.

Jane Burnett is an Assistant Editor at Oprah Daily, where she writes a variety of lifestyle content for the editorial team. She's a journalist with a pop culture sweet tooth—when she isn't catching up on celebrity news, she's usually listening to a podcast! Jane was previously an on-air reporter in local news, and worked at Thrive Global, Ladders News, and Reuters. She also interned at CNBC through the Emma Bowen Foundation, and is a member of the National Association of Black Journalists (NABJ).