Tori Dunlap, author of Financial Feminist, believes that money should not be a source of guilt or shame: “Money is meant to be a tool you use to build a life you love.” So we asked Dunlap, along with other financial experts, to share the shopping and saving strategies that have the biggest bang for the buck.

You might have seen one—or a thousand—TikTok posts on paying for everything in cash, or dividing your monthly spending money into envelopes. They say it will keep you aware of what you are spending and make you save money. (One guy even says it’ll help you lose weight.) Don’t listen to them, says Dunlap. “Automate everything you possible can,” she says, not only setting up direct payments of bills from your checking account but also using the debit card attached to your checking account for as many purposes as possible. (Dunlap says you can use a credit card instead, as long as you pay it off in full at the end of every month.) And while you’re at it, prioritize your savings: “Even if you can only do $20 a month, set up an automatic transfer from your checking to savings account on the first of every month or on the day you get paid.”

At the end of your first month of automating your spending (as much as is possible), go through your bank and debit card statements. What did you buy that made you most happy? What did you spend money on that made you feel “meh”? What did you buy that you now regret? Now go back through the list and ask yourself why you made those purchases. “Did I buy that pair of shoes I don’t need because that day my boss made me feel like sh*t?” says Dunlap. Did the shoes “work” to improve how you felt? (If not, that’s great information that will keep you from making your bad days worse in the future.)

More From Oprah Daily

Now pick the three categories that bring you the most joy in your life. (Dunlap’s three are food, travel, and plants.) Knowing what your spending priorities are—what you value most—will help you spend more mindfully. The idea is not to deprive yourself of what you love, because that will backfire. “We know deprivation doesn’t work because we know that virtually all diets don’t work,” says Dunlap. A financial diet is no different. So the idea is to cut back on the easy stuff—the things you don’t actually care much about.

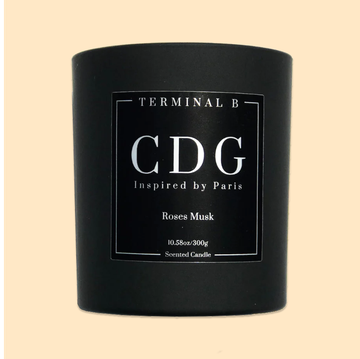

If one of your joy categories requires saving money (travel, buying a home, going to college), decision scientist and behavioral economist James Langabeer suggests putting a picture of that goal in your wallet—one that you see every time you open it. The visual will help reinforce mindful spending, he says.

Beware of retailer tricks to entice you spend more. For instance, some stores have mirrors that make customers look longer and leaner; they also light the space so you look glowier. So try on clothes at home and make sure they fall into your happy category before taking the tags off. Supermarkets are way into this game, too. Have you noticed how much bigger your shopping cart has become? Marketing consultant Martin Lindstrom once told Today.com that his firm did an experiment that doubled the size of the shopping cart and found that people unknowingly bought 40 percent more. Also, some grocery stores always smell like fresh bread or melt-in-your mouth cookies because they’re blowing air from the bakery throughout the store (or using scent machines) to entice you to buy those products. So don’t follow your nose; follow the list you definitely made (right?) and stick to it.

You might also want to outsmart your own brain. A study published in the Journal of Consumer Psychology found that shopping makes people feel—very temporarily—“in control.” That’s an enticing feeling when the world feels very out of control. It’s also well-known that shopping gives us a dopamine hit, making us feel happier—again, very temporarily. But if you’ve been using retail therapy to lift your spirits, there’s good news from the Cleveland Clinic, which recently reported that you don’t have to buy anything to get the dopamine hit; just window shopping gets that neurotransmitter going.

Amanda Robb is a New York–based journalist who produced season 7 of the podcast Someone Knows Something.