A few weeks before the first Covid lockdown began, I noticed a few small white spots on my forearms. As a SoCal beach girl who grew up in the sunscreen-free ’80s—oof—I figured it was sun damage. So did my dermatologist. Then the tiny sprinkles turned into paint splotches. I started treatment for tinea versicolor, a common skin fungal infection, but that was fruitless, and before long, huge swaths of my arms were milky white, which, as an already pale white girl, is saying a lot. That’s when I was handed a surprising diagnosis: vitiligo.

I've never even been able to commit to a tattoo, so the idea that my new piebald appearance was most likely permanent was a lot to process—especially in those early panicked days of the pandemic, when grocery shopping with a visible skin condition made me feel even more self-conscious and ostracized. The autoimmune disease affects one in 100 people in the U.S., yet vitiligo is shrouded in a lack of understanding, stigma, and underrepresentation. In honor of Vitiligo Awareness Month, I asked Nada Elbuluk, MD, clinical associate professor of dermatology at USC Keck School of Medicine and founder and director of the USC Skin of Color Center and Pigmentary Disorders Program, to shed some light on the condition.

What is vitiligo?

“Vitiligo, in a nutshell, is an autoimmune condition, where people’s antibodies are attacking a skin cell called a melanocyte,” says Elbuluk. Melanocytes produce and contain melanin, or pigment, so “wherever they get destroyed is where people develop these white patches that we call vitiligo.”

More From Oprah Daily

How do you get it?

First things first: It’s not contagious. And it’s an equal-opportunity condition. “There are no demographic differences that we’re aware of, either with gender or racial/ethnic groups,” Elbuluk says. People who develop vitiligo are genetically predisposed to it. But when and how the condition presents is a bit more mysterious, nebulously influenced by environmental factors, personal health, and even someone’s mental state. “At some point, that predisposition is going to combine with some other trigger in your life for the vitiligo to come out,” Elbuluk says.

Oftentimes, the trigger is some sort of injury. “That can be something as simple as ‘I skinned my knee, and then I saw vitiligo there,’” Elbuluk says. “Or ‘I got a really bad sunburn when I was in my 20s, and then I got vitiligo.’” Another common trigger: stress. Like, say, the anxiety-inducing cocktail of parenting and working during a global shutdown from a rampant, unknown virus. Jon Hamm, another famous vitiligan (yes, I just invented that word), has said his depigmentation started shortly after he was cast as Don Draper in Mad Men. (Uh, no pressure.) But for many, it’s hard to pinpoint a trigger.

Can it be treated?

There is no cure, but there are treatments aimed at slowing or stopping vitiligo’s spread—which can range from a localized area to all over the body—and restoring skin color in depigmented areas. Topical creams are the most common; oral medicines can be prescribed for really active, widespread cases (though the side effects can be more physically detrimental than vitiligo); and certain minerals and supplements seem to help. Last year, the first-ever FDA-approved topical treatment, what’s known as a JAK inhibitor, was released, meaning that the condition is finally getting some more attention in the medical field. And one of the most long-standing treatments is light therapy. “What’s most successful is a combination approach,” says Elbuluk.

Is it harmful?

Vitiligo is a medical condition, but it won’t kill you, it doesn’t hurt, and though its spread is completely unpredictable, its effects are mainly aesthetic. It is, however, associated with other autoimmune diseases: “Up to 20 to 30 percent of people can also have thyroid disease,” Elbuluk says. So far, vitiligo is my only condition, but I make sure my health practitioner regularly screens for anything else that may pop up.

The real toll of vitiligo is on mental health. “It can have really profound psychological and emotional effects on people—their self-esteem, their self-confidence—and I have found this to be true across skin colors,” Elbuluk says. “A lot of people don’t feel comfortable with their vitiligo being visible or known to the world.”

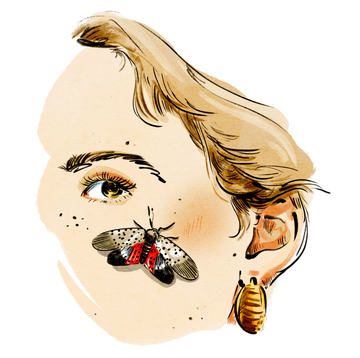

That’s how I was feeling when I decided to try to regain some pigmentation. It hadn’t been a priority when I’d been holed up at home, but once the world opened up again, easing back into socializing with totally different skin—fielding side-eye from strangers and lots of questions from kids (my preference!)—was an emotional struggle. By this time, I had vitiligo on every part of my body—splotches on my face, neck, and chest; random spots on my back and belly, “confetti” sprinkles on my thighs; and tie-dye-like patterns on my lower legs.

My derm started me on a topical cream for my face and arms, a supplement regimen (vitamins D, C, and E, plus alpha lipoic acid, an antioxidant), and light therapy two times a week, which had me driving to a treatment center in downtown L.A. and standing naked in what looks like an old-school tanning booth to get zapped with a particular UV light known to stimulate pigmentation. Within a few months, I started getting freckles on my arms, and those freckles slowly expanded until most of the white patches on my arms and hands had filled in. And then? I stopped light therapy. It just wasn’t worth it. I’d gotten used to my splotchy skin and people’s reactions to it. Plus getting to appointments was a royal pain in the ass, and the copayments were adding up. I decided to put that energy into enjoying my body no matter what it looked like.

What about the mental impact?

Elbuluk often recommends speaking with a psychologist for support, or a psychiatrist, especially for patients with depression or anxiety. “Local groups can be really powerful for people with vitiligo and for families, especially parents of children with vitiligo,” she says. She’s a board member of the Global Vitiligo Foundation, an organization for medical practitioners and those living with vitiligo alike. They host an annual symposium, offer an online community, and have a searchable database of local support groups.

For me, the body positivity movement helped shift my attitude toward acceptance. They don’t have vitiligo, but size and disability activists like Virgie Tovar and Ruella-Maria Matson remind me how good inclusivity feels, and to give myself that grace as well. Plus, as a near lifelong feminist, I’ve had a lot of practice in reclaiming my body and unsubscribing from the impossible beauty standards of a patriarchal society. I still take vitamins, which are good for my health in general. I also manage my stress the best I can, but there’s always a new white spot to contend with. Turns out celebrating them feels way better than constantly trying to overcome them.

Representation helps more than anything. Seeing Winnie Harlow on the runway or the cover of a magazine makes my heart sing. In 2020, Mattel released a Barbie with vitiligo, and every time I spy a skin-dappled model in an ad or a fashion spread or in the photos of an online shop I love, I relish the normalization. The Instagram account @vitiligo.beauty is also a salve when self-consciousness creeps in. These days, thankfully, that’s a rare occurrence. It took a few years, but I’ve managed to go from just living with vitiligo to actually loving it, because these spots have only strengthened my steadfast sense of self.