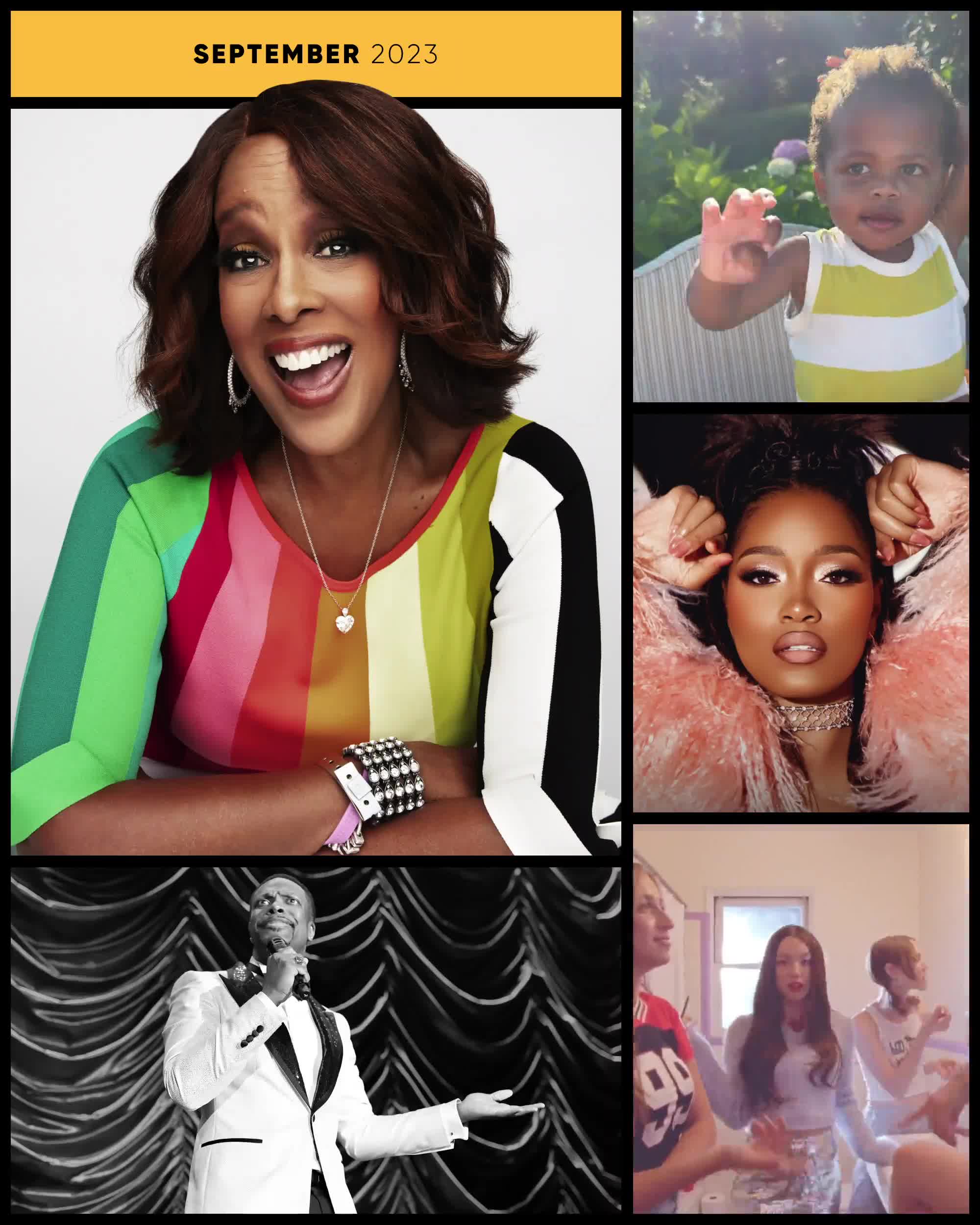

“The World According to Gayle” is Oprah Daily’s video series spotlighting all things Gayle each and every month. Our editor at large is sharing her favorites of the moment, from buzzy new albums to comedy tours you’ll want to try for yourself. Check back each month to see the latest!

September is a special month, don’t you think? It marks the start of a new season, and it comes with a fresh start: All the kiddies head back to school, and the air gets crisp. My favorite part of the month, though, is celebrating favorite grandson Luca, who turns 2! Grandparent’s Day lands on September 11, so there’s an extra chance to show some love. (But who am I kidding? I don’t need an excuse or a holiday to do that.) A good friend of mine, the legendary “boss,” Bruce Springsteen, turns 74 this month, and on his birthday, he gets his own holiday. The state of New Jersey, his home state, is honoring him with Bruce Springsteen Day on September 23—congratulations to him! For more of what I’m looking forward to this month, watch below.

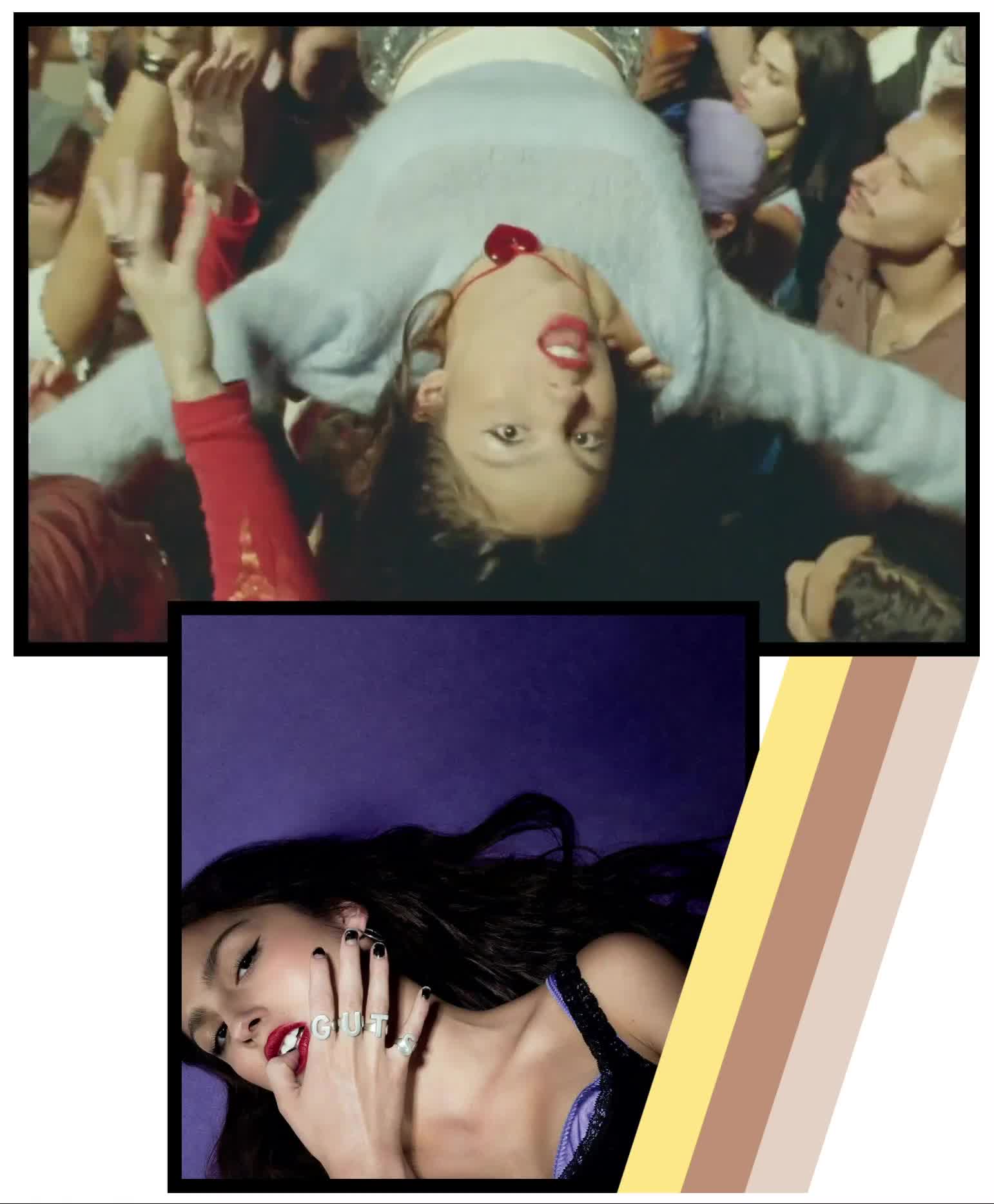

Olivia Rodrigo’s got Guts

Olivia Rodrigo is out with her sophomore studio album this month, called Guts. I listened to her first two singles, “vampire” and “bad idea right?" and I have always been an Olivia fan, but I just love how raw the lyrics are on this album so far. We’ve all been there where we say “Seeing you tonight” might be a “bad idea, right?” I’ll speak for the class: Yes. Olivia always speaks what’s on her mind (and all of ours sometimes) so I can’t wait to hear the whole thing. Listen when the entire album drops on September 8.

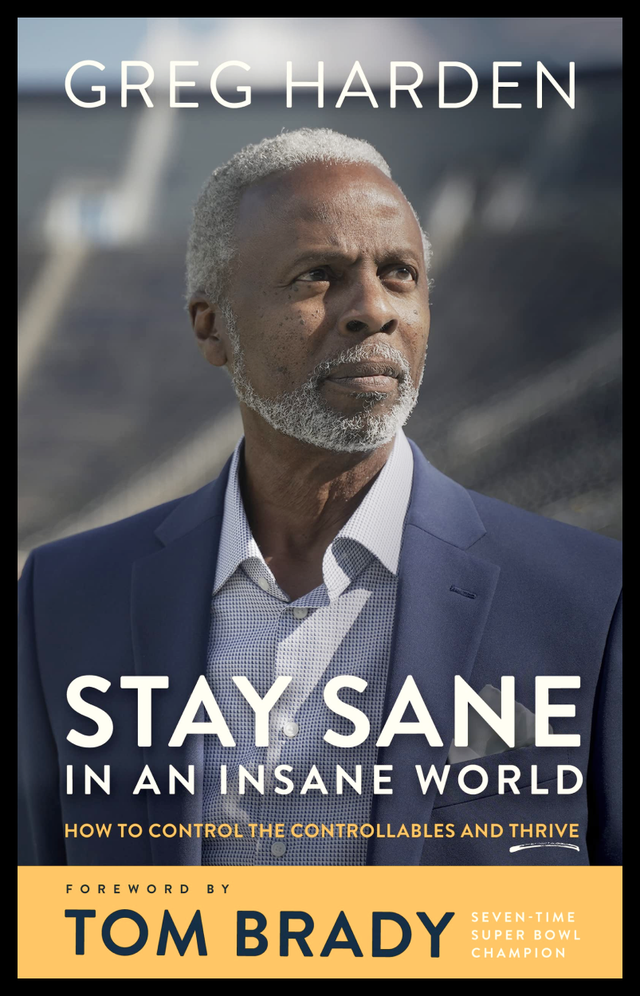

How to Stay Sane in an Insane World, According to Greg Harden

I met Mr. Greg Harden when I interviewed him on your favorite morning show, CBS Mornings. He was there to talk about his book, Stay Sane in an Insane World, which I was blown away by. You see, Greg is a life coach and a motivational speaker, but he doesn’t call himself a therapist—even though, after hearing him, you feel as if you’re getting so much sound advice you’ll need two pads of paper to jot it all down. Just ask Tom Brady and Desmond Howard, two celebrities who have learned from his progressive thinking firsthand. You don’t need to be an athlete to learn from Greg, just someone ready to change their mind in an effort to become their best self. I’ve already recommended it to so many people, and now I’m recommending it to all of you.

Hello, Wild Fang

I’ve been spending a lot of my summer concert-going (Beyoncé’s Renaissance World Tour is a must-see), and when I went to Taylor Swift’s Eras Tour and sported my neon green Wild Fang coverall, I got so many compliments. Wild Fang creates gender-neutral clothing that is sustainable and trendy. (I loved my coverall so much that I purchased two more.) You can shop all the styles online, or, for the Insiders living in Los Angeles or Portland, you can shop in person.

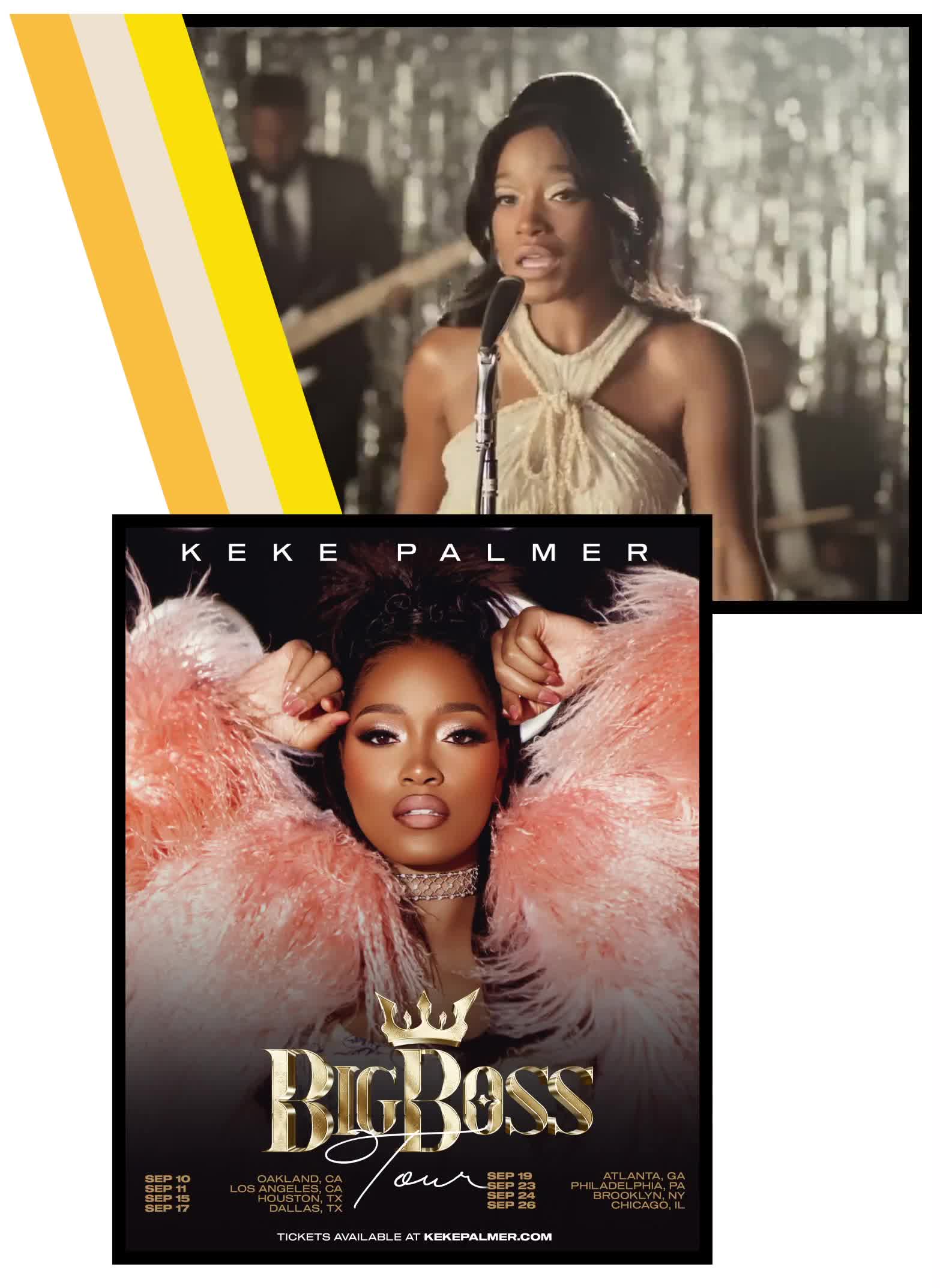

Laugh out loud with KeKe Palmer and Chris Tucker

Do you know who is having a moment right now? KeKe Palmer. Every chance I get to talk to KeKe, I take it because she’s such a bright star. KeKe gave birth to a baby boy back in February, and she’s showing us that you can really do it all. First with her new album, Big Boss, accompanied by a short film, and now she’s taking the show on the road for a comedy, music, a-little-bit-of-everything entertainment tour. The super-talented Chris Tucker is also starting a new act this month with The Legend Tour. He's not only hilarious, but a really nice guy. KeKe kicks off on September 10 in Oakland and Chris starts off in South Carolina on September 8. Grab your tickets and get ready to laugh out loud.

I want to hear from you! Let me know what you think of my list in the comments below. And what should I be looking forward to next month?

Gayle King is the Editor at Large at Oprah Daily and co-host of CBS Mornings. When she's not on air, Gayle is diving into all things news, trending topics, and pop culture. Yet, her favorite job is being the mom to her favorite daughter, Kirby, favorite son, Will, and grandmother, or as she prefers it, Gaia to her favorite grandson Luca. Follow her on Instagram.