So before we get started, let’s clear something up: Positivity isn’t all bad. When used correctly, it’s great. Experts agree that positive feelings like gratitude, contentment, optimism, and self-confidence can lengthen our lives and improve our health. Many of these claims are exaggerated, but there is value in positive thinking. People who report having more positive feelings are more likely to have a rich social life, to be more active, and to engage in more health-promoting behaviors. I think we can all agree that it is healthy to feel positive when it comes from a genuine place.

But somewhere along the way, we constructed this idea that being a “positive person” means you’re a robot who has to see the good in literally everything. We force positivity on ourselves because society tells us to, and anything less is a personal failure. Negativity is seen as the enemy, and we chastise ourselves and the people around us when they succumb to it. If you’re not positive, you’re a drag to be around. Healthy positivity means making space for both reality and hope. Toxic positivity denies an emotion and forces us to suppress it. When we use toxic positivity, we are telling ourselves and others that an emotion they are having shouldn’t exist, it’s wrong, and if we try just a little bit harder, we can eliminate it entirely.

When we know that our emotions are meant to be experienced and that they are not something we need to run from, it makes it easier to move into a place of optimism.

More From Oprah Daily

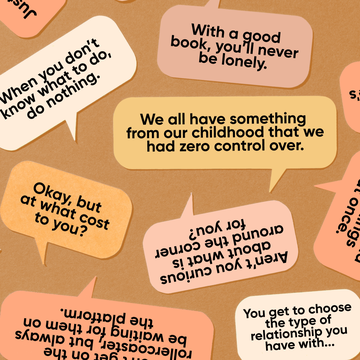

Here are 9 phrases that might be doing more harm than good:

- “Don’t cry!”

We usually say this because we’re uncomfortable sitting with someone who is emotional. Crying is helpful, normal, and allowed. Telling someone not to cry implies that what they’re doing is wrong and encourages them to suppress their emotions. - “You have so much to be grateful for.”

We can feel upset while also being grateful for what we have, but this feels dismissive and silencing in a moment of struggle. - “Time heals all wounds.”

Time doesn’t heal all wounds. Telling someone this when they are very much not over something can be insensitive and shaming. Only they get to decide when they’ve healed, and sometimes we don’t “get over it.” - “At least it’s not ____.”

Anything with “at least” in front of it is minimizing. It’s not helpful to compare suffering. (At least you’re not dead, right? Is that helpful? Didn’t think so.) - “Your attitude is everything.”

This is an oversimplification of our reality. Many studies show that an entire network of factors contributes to someone’s success. Their attitude is an important factor, but it is not everything. - “Be grateful for what you learned.”

This is particularly harmful after someone has experienced a traumatic event. Sadly, I commonly see this used after someone has been abused. Yes, we will eventually learn from our struggles, but it doesn’t mean we have to be grateful for that lesson. Often the price is too high. - “It could be worse.”

True. It could also be better. This statement minimizes and also informs the person that their suffering isn’t justified because it’s not the “worst.” - “Cut all negativity out of your life.”

A life without negativity is a life devoid of learning and growth. If we cut all negative people or experiences out of our life, we will end up alone and emotionally stunted. - “Never give up.”

There are certain situations when giving up is very brave or necessary. It doesn’t always mean that the person was weak or couldn’t handle it. Often it means they were strong enough to know when to walk away.

Reprinted with permission from Toxic Positivity, by Whitney Goodman, published by TarcherPerigee, an imprint of Penguin Group, a division of Penguin Random House, LLC. © 2022 Whitney Goodman.

Whitney Goodman is the psychotherapist behind the popular Instagram account @sitwithwhit and owner of the Collaborative Counseling Center, a private therapy practice in Miami.